It’s safe to say Nvidia (NASDAQ:NVDA) hasn’t just benefited from the rise of AI – it has defined it. Its chips have become the backbone of modern artificial intelligence, selling at a record pace and powering the world’s most advanced systems. But lately, given all the hype surrounding AI and the abundant stock market gains, some investors have begun to wonder if we are now in AI bubble territory.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cantor’s C.J. Muse strongly disagrees. The top 1%–ranked analyst argues that we’re still in the “early innings of a multi-trillion AI infrastructure build-out,” where hyperscalers alone provide visibility into hundreds of billions in demand over the next several years. Beyond that, he points to accelerating adoption across Neo-Clouds, enterprise customers, and emerging physical AI applications as evidence that this cycle has far more room to run.

“Thus, this is not a bubble, and we are still in the early innings of this investment cycle,” said the 5-star analyst.

Muse’s conviction was further reinforced after recent investor meetings with Nvidia’s top brass, including CEO Jensen Huang and CFO Colette Kress. Among the key takeaways was the company’s new partnership with OpenAI, designed to position the ChatGPT maker as a self-hosted hyperscaler. The strategy aims to remove “margin stacking” from server ODMs and CSPs, narrowing the cost gap between Nvidia and ASICs to roughly 15% – a move Muse calls a “win-win for both” that could intensify pressure on the ASIC market.

Nvidia is also pushing forward with its Extreme Co-Design approach on an “annual cadence,” optimizing the entire AI infrastructure end-to-end. Customers, Muse notes, are no longer just buying chips – they’re buying the capability to deploy AI at scale, made possible through Nvidia’s comprehensive full-stack platform, including CUDA-X. “Put simply,” adds the analyst, “Jensen and the team are as focused and competitive as ever, and they are playing to win (per Jensen, ‘Getting S*** Done’), and we do not see a scenario where NVDA does not secure at least 75% of the AI Accelerator market over time.”

Following three days of meetings, Muse’s confidence in both Nvidia’s dominance and the long-term AI infrastructure expansion “increased considerably.” The analyst now sees $8 in EPS by 2026 (versus the Street’s $6.26) and $11 by 2027 (compared to $7.36 consensus). “Considering a backdrop of out-year consensus potentially still 50% too low, NVDA remains our Top Pick and continues to offer the most upside,” Muse summed up.

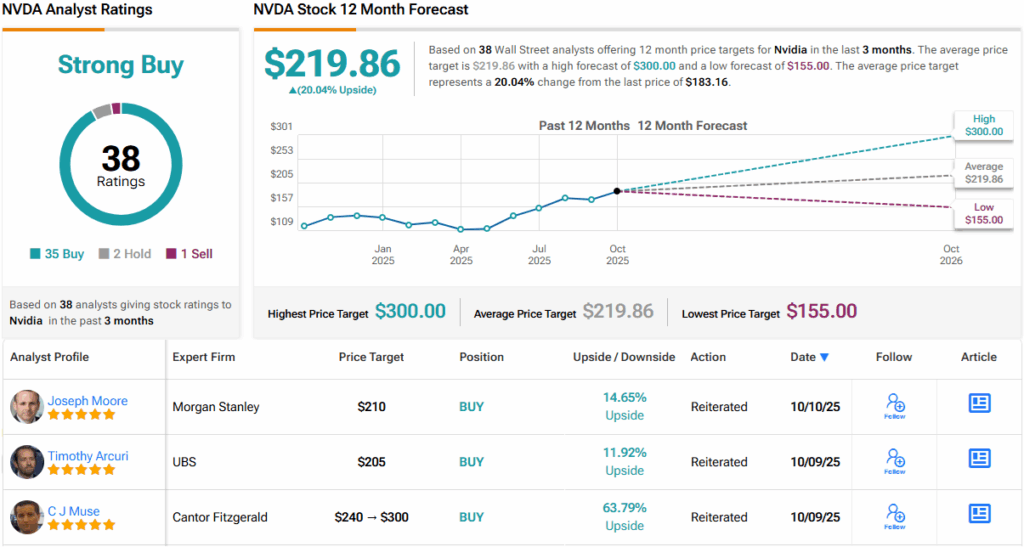

Accordingly, Muse assigns NVDA stock an Overweight (i.e., Buy), while raising his price target to a new Street-high of $300 (up from $240), suggesting the stock will gain ~64% in the months ahead. (To watch Muse’s track record, click here)

The Street’s average price target is a more modest $219.86, a figure that points to one-year share appreciation of 20%. On the rating front, the stock claims a Strong Buy consensus view, based on a mix of 35 Buys, 2 Holds, and 1 Sell. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.