Tzoni Raykov

Tzoni RaykovTrading cryptocurrency was just a bit of fun for Tzoni Raykov, but losing $1,500 worth to an administrative error has left him with serious concerns about his treatment by the industry.

The oil engineer has held an account with Revolut for several years – using its app to split bills with friends after going out for dinner or drinks. They would pay each other using traditional currency, like the pound sterling or US dollar.

But after seeing the e-money firm advertise its cryptocurrency services, he decided to give it a try.

What Tzoni thought would be a straightforward transfer of cryptocurrency coins has left the Bulgarian national angry and out of pocket.

His experience highlights some of the frustrations people have had using cryptocurrency where many of the customer safeguards which underpin standard online banking transactions, some mandated by law, do not apply.

“When they treat you like this, it makes you feel like you can’t do anything,” he told BBC News. “Like you are powerless.”

While the cryptocurrency market is dominated by Bitcoin, there is a plethora of other digital currencies, including USDC – which Tzoni had already amassed in a separate crypto account.

His frustrations began in February when he decided to transfer some of his USDC coins to his Revolut account.

As a precaution – which Revolut suggests doing – he first sent 10 of the coins, worth $10. It was a success and the funds were credited to his Revolut account.

Days later he tried to make a larger transfer of what he thought was 1,500 USDC. The transfer was completed but, this time, the funds were not credited to his account.

Tzoni says the problem occurred because Revolut’s deposit instructions were unclear.

When you transfer cryptocurrency from one account to another, you have to select a network to send it through – like choosing which courier service to use when sending a parcel.

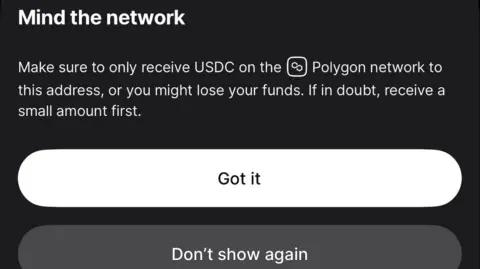

Revolut’s deposit instructions say to transfer USDC to it, you have to use a network called Polygon. In his first, successful, deposit Tzoni selected one called “Polygon PoS”.

In the second deposit, when he tried to transfer 1,500 USDC, he selected a different network – “Polygon (bridged)”.

He thought it would work just as well but says instead it caused the coins to be converted into USDC.e – a different cryptocurrency.

This is what Revolut received. The company does not handle USDC.e coins.

Tzoni Raykov

Tzoni RaykovAfter seeing his Revolut account had not been credited with the 1,500 coins, Tzoni contacted the Revolut support team.

In messages seen by BBC News, they told him the issue seemed to be with “the specific type of Polygon network used, which led to the conversion”.

In another, he was told: “The app currently specifies ‘Polygon’ without differentiating between standard and bridged options. I’ll note your feedback for future improvements.”

Tzoni thinks if Revolut’s deposit instructions had been more specific, his problem would have been avoided.

When approached by BBC News about this case, Revolut gave a different answer.

The firm said the problem was not because Tzoni had used the wrong Polygon network – which he claimed turned his coins into USDC.e.

The deposit failure was “not because the network itself had ‘converted’ the token”, it said, without explaining why its support team had suggested to Tzoni that it was.

Revolut told us the deposit ultimately failed because the USDC.e coins it received were not supported by the company’s technology.

It said: “As is standard industry practice due to the significant technical challenges involved in supporting every combination of token and chain, the recovery of these unsupported assets does not sit within Revolut’s scope.”

It means the 1,500 USDC.e coins have not been credited to Tzoni’s account or sent back to him.

‘They are waiting for me to give up’

To Tzoni’s mind, this isn’t acceptable treatment from a company of Revolut’s size and reputation, which handles normal banking deposits as well as cryptocurrency, stocks and commodities.

Revolut says it has 10 million users in the UK while last year it was granted a provisional banking licence, paving the way for it to become a fully fledged UK bank.

When using a High Street bank, a mistaken transfer of traditional currency would usually be resolved with the money being reverted back to the customer.

This was established in 2014 in a voluntary code of practice that most UK banks signed up to. There is no such equivalent in the cryptocurrency industry.

After contacting Revolut several times in recent weeks, Tzoni has been told the coins are effectively lost.

“They are waiting for me to get bored and give up, to accept the money is gone. But I won’t,” Tzoni said, pointing out the coins are in the Revolut system. “It is ridiculous that they can behave like this.”

While Tzoni’s loss of cryptocurrency is significant to him, the sum is tiny compared with the size of the industry, which has risen sharply in value over the past 18 months.

Reuters

ReutersThe global market peaked in value at $3.9tn last December, following the re-election of Donald Trump. Since then it has fallen by $1.1tn, according to tracking website CoinGecko.

Government policies in the US and other countries are also changing to favour the cryptocurrency industry, even though it has suffered several scandals.

FTX, one of the world’s largest cryptocurrency firms, went bankrupt in 2022. Sam Bankman-Fried, its chief executive, was sentenced to 25 years in prison last year for defrauding customers of billions of dollars.

Investigators also found FTX was using QuickBooks, a popular accounting software designed for individuals and small businesses, to manage the money.

John Ray III, a lawyer tasked with recovering funds from FTX for defrauded customers, told a bankruptcy court: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

He later told a congressional hearing: “Nothing against QuickBooks. It’s a very nice tool, just not for a multibillion-dollar company.”

‘More regulation is needed’

A couple of months ago Bybit, the world’s second largest cryptocurrency exchange by some estimates, was tricked out of $1.5bn worth of coins by hackers thought to be working for North Korea.

The firm had been using Safe, a free digital storage software popular with individuals who want to store cryptocurrency on their own devices, as part of their business operations.

Following the theft, Bybit’s chief executive said they “should have upgraded and moved away from Safe” earlier.

One of the problems with cryptocurrency firms, says Prof Mark Button, who researches cybercrime, is they can grow very quickly, which means they don’t always keep up with the accounting and security challenges of managing so much money.

“For me it illustrates that if we are going to be serious about cryptocurrencies in the future… there needs to be some kind of regulation.”

In Tzoni’s case, it might have been easier for him to get his cryptocurrency back or be compensated if there were laws stating what firms need to do if they are sent a coin they don’t handle.

Higher industry standards might also have prevented him making such a transaction in the first place.

Mykhailo Tiutin is chief technology officer at AMLBot, a company that analyses how risky cryptocurrency transactions are.

Their service runs checks similar to those supported by banks, where details for a transfer, such as the account holder’s name, sort code and account number, are verified.

He says cryptocurrency is safe enough for the average person to use but that they should be careful about which products and services they choose. He says he has also lost cryptocurrency after making an administrative mistake.

“You have to do your own research,” he told us. “The successes and the losses are ultimately at your own risk.”